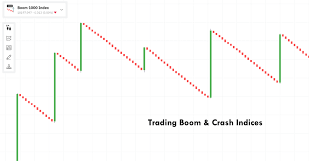

Hi everyone, in this post would disscus how to trade Boom and Crash index markets using just the relative strength index.

First of, you need to set up a 200 exponential moving average with any colour of your choice.

Second thing is to go to the RSI and moving averages.

1- Relative Strength Index

Period: 1

Apply to Close

Choose any style of your choice

Level: 10- Strong Buy

Level: 50- Wait or TP

Level: 90- Strong Sell

2- Moving Averages

i- Period: 5

ii- Shift: 0

iii- Method: Simple

iv- Apply to: Close

v- Style: Green

3- Moving Averages

i- Period: 3

ii- Shift: 0

iii- Method: Simple

iv- Apply to: Close

v- Style: Orange

4- Moving Averages

i- Period: 2

ii- Shift: 0

iii- Method: Exponential

iv- Apply to: Close

v- Style: Red

5- Moving Averages

i- Period 50

ii- Shift: 0

iii- Method: Exponential

iv- Apply to: Close

v- Style: Blue

Main Chart

6- Bollinger Bands

i- Period: 20

ii- Shift: 0

iii- Deviation: 2.00

iv- Apply to: Low

7- Commodity Channel Index

Period: 5

Apply to: Typical Price

Style: Any style of your Choice

Levels : -100 Buy

-140 Strong Buy

100 Sell

140 Strong Sell

How To Trade and Detect Spike in a Boom and Crash Market

1- Figure out the market directions whether uptrend, sideways or downtrend

2- Candles should be around the lower Bollinger's band in case of boom market and close to upper Bollinger's band in case of Crash Market

3- All the moving averages in the RSI should be converged either at the Strong buy level or 10 for the boom market or Strong Sell level or 90 for Crash Market as the case maybe

4- CCI should be below the buy level for boom market and and above the sell level for sell market.

5- For Take Profit once the candlesticks is approaching the higher Bollinger's band for boom market or once it reaches the take profit zone on the Rsi indicator.

The opposite applies to crash market as well in the area of take profits.

6- Last but not least, get off the market as soon as the target to avoid feeding what you get back to the market and avoidance of drawn downs once the spike is caught up with.

That's all as regards the write-up on trading strategy and happy blogging. More would be greatly reviewed in the coming posts.

Happy Blogging and Reading 💥💥💥💥

Video from Joseph Fxking YouTuber